TVOL — Theoretical Volatility

TVOL (Theoretical Volatility or "TheoreticalVol”) is defined as any calculation of the RealVol futures price, based on associated options premiums, and employing the Heston model [Here is the link to Wikipedia’s version http://en.wikipedia.org/wiki/Heston_model]. Of course, there are many market forces such that RealVol futures may not trade at their model-derived theoretical volatility value.

For example, by using the Heston model we are assuming that this is the “best” or “correct” model to price RealVol futures. All models make assumptions about the state of the market. The Heston model is no exception. Those assumptions may not be valid at all times. We are also assuming the inputs (associated options premiums) are “correct” or are trading at their theoretically correct value. As we know, such assumptions are not always valid. Finally, even if the model had come up with the “perfect” theoretical value, such a price may not have actually provided the trader with a profit. Therefore, one should not base a trade or strategy solely on a model-derived assumption of theoretical pricing.

The complete TVOL calculation requires not only a pricing model but also a root-mean-square (RMS) calculation. [Here is the link to Wikipedia’s version http://en.wikipedia.org/wiki/Root_mean_square]. RMS adjusts the model pricing for the fixed start date of a RealVol futures. Both the Heston Model and the RMS calculation are described below.

Calculation of RealVol Future Prices under the Heston Model

RealVol futures are essentially exchange-traded over-the-counter volatility swaps, so the pricings should be similar. However, unlike volatility swaps, which normally start their RealVol calculation period (CP) immediately upon creation, RealVol futures typically start their CP on a pre-defined date in the future. All RealVol futures have a CP. Most RealVol futures have both an Anticipatory Period (the time period prior to the start of the CP) and a CP. Before we can describe how to determine a theoretical price for RealVol futures, we will show how to price a volatility swap using the Heston model. Finally, a RMS calculation will adjust the theoretical value for the fixed start date of RealVol futures.

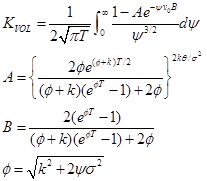

Under the Heston model, a Volatility swap that has time to maturity  can be priced using the following formula: can be priced using the following formula:

Where  are Heston parameters calibrated to the associated option prices. are Heston parameters calibrated to the associated option prices.

is the mean-reverting speed, is the mean-reverting speed,

is the long-term volatility, is the long-term volatility,

is the initial volatility, and is the initial volatility, and

is the volatility of volatility is the volatility of volatility

Data Selection

Before calibration is performed, it is standard practice to filter the available data set to eliminate outliers and thereby stabilize parameter estimation, ensuring the most efficient calibration. As proposed by Bakshi et al., [“Empirical performance of alternative option pricing models.” The Journal of Finance, 52(5):2003–2049, December 1997], we remove options that have the following characteristics from the calibration process:

- Options with zero volumes, i.e., non-traded options

- In-the-money options

- Options with no bid or no ask

- Options with price lower than 0.05

Calibration

A common solution is to find the Heston parameters that produce the correct market prices of associated options premiums. In other words, although we cannot reconfigure the formula to solve the equation for each parameter, we can furnish an estimate of each value, calculate the result, and then compare the output to the real-world price. If they match, then the estimate was correct. If not, then another estimate is entered, and the whole process starts anew until a match is found. Unfortunately, since we are attempting to estimate four variables at the same time, the process can be quite intense, even for a fast computer.

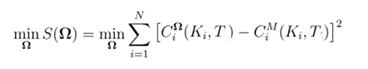

The most popular approach to solving this problem is to minimize the error or discrepancy between model prices and market prices using the following formula:

Where Ω is a vector of parameter values, CΩ and CM are the option prices from the model and market, respectively, with strike Ki and maturity T, and N is the number of options used for calibration.

As for calibration algorithms, we use Differential Evolution (this is a genetic algorithm, which is a global optimizer) and Python "fmin_slsqp" (this is a non-linear least-square algorithm, which is a local optimizer). At the first day of the listed RealVol futures, we use the Differential Evolution algorithm to calibrate the model. This method gives a global minimum. From the second day on, we use the set of parameters from the previous day as the starting point and use fmin_slsqp to do the calibration. We do this because the parameters do not move much from day-to-day, so a local optimizer with a good starting point is normally sufficient for our purposes.

Pricing within the Anticipatory Period

Once we have calculated a theoretical volatility-swap price, we need to adjust that price for the forward-starting feature of a RealVol futures to get the ultimate theoretical value of a RealVol futures (TVOL™). At any point during the Anticipatory Period, the TVOL depends on two volatility-swap prices, one expiring at the start date of the CP (the end date of the Anticipatory Period), and the other expiring upon expiration of the RealVol futures (the end date of the CP). During the Anticipatory Period, the TVOL can be obtained by applying an "inverse" root-mean-square formula to these two theoretical volatility-swap prices.

Let

= time to the end of the anticipatory period (which is also the start of the CP), = time to the end of the anticipatory period (which is also the start of the CP),

= time to the end of the CP, = time to the end of the CP,

= time to the front-month option expiration, = time to the front-month option expiration,

= time to the back-month option expiration, = time to the back-month option expiration,

= volatility swap price expiring at = volatility swap price expiring at and and

= volatility swap price expiring at = volatility swap price expiring at  . Then, . Then,

, at time t = the theoretical value of RealVol futures expiring at , at time t = the theoretical value of RealVol futures expiring at

We know that

, since RealVol futures expirations match option expirations, and , since RealVol futures expirations match option expirations, and

, with 21 representing the number of trading days in the CP of a 1VOL. Similarly, we use 63 in place of 21, representing the number of trading days in the CP of a 3VOL. , with 21 representing the number of trading days in the CP of a 1VOL. Similarly, we use 63 in place of 21, representing the number of trading days in the CP of a 3VOL.

The relationship between  and and  depends on the calendar. Let’s assume that depends on the calendar. Let’s assume that  for now. for now.

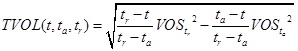

Suppose that we are at any time . We select and filter the options that are expiring at . We select and filter the options that are expiring at and and , and then do the calibration based on the methodology outlined for finding a set of Heston parameters. We then calculate , and then do the calibration based on the methodology outlined for finding a set of Heston parameters. We then calculate  and and  using the volatility swap formula. Finally, we can calculate the RealVol futures value using the following inverse root-mean-square formula: using the volatility swap formula. Finally, we can calculate the RealVol futures value using the following inverse root-mean-square formula:

If  , since the options with , since the options with maturity have already expired, we select only those options with maturity have already expired, we select only those options with maturity for calibration and pricing. maturity for calibration and pricing.

Pricing within the RealVol Calculation Period

At any point during the CP, the TVOL depends on both the PVOL and the volatility-swap price with maturity at the end of the CP. The TVOL can be obtained by applying a root-mean-square formula to these two quantities.

Let

= time at the start of the CP, = time at the start of the CP,

= time to the end of the CP, = time to the end of the CP,

= time to option expiration, = time to option expiration,

= PVOL at time = PVOL at time , and that starts from time , and that starts from time , and , and

= volatility swap price expiring at = volatility swap price expiring at  . Then . Then

at time t = the theoretical value of a RealVol futures expiring at at time t = the theoretical value of a RealVol futures expiring at . .

We know that

, since RealVol futures expirations match option expirations, and , since RealVol futures expirations match option expirations, and

with 21 representing the number of trading days in the CP of a 1VOL, and 63 in place of 21 representing the number of trading days in the CP of a 3VOL. with 21 representing the number of trading days in the CP of a 1VOL, and 63 in place of 21 representing the number of trading days in the CP of a 3VOL.

Suppose that we are at time  ( ( ). We select the options with maturity ). We select the options with maturity , perform the model calibration and price the , perform the model calibration and price the , and then also calculate the , and then also calculate the  based on the RealVol daily formula. Finally, the TVOL can be calculated using the following root-mean-square formula: based on the RealVol daily formula. Finally, the TVOL can be calculated using the following root-mean-square formula:

We can see from the formula that when , the TVOL is determined only by , the TVOL is determined only by  , while when , while when  , it is determined only by , it is determined only by . Thus, upon expiration, the RealVol futures are ultimately settled to the appropriate RVOL index (1RVOL for the 1-month version. or 3RVOL for the 3-month version), which is the realized volatility, as calculated by the RealVol daily formula, over the entire period. In other words, the partial volatility (PVOL) converges to realized volatility (RVOL) for the entire CP after all of the data are known. . Thus, upon expiration, the RealVol futures are ultimately settled to the appropriate RVOL index (1RVOL for the 1-month version. or 3RVOL for the 3-month version), which is the realized volatility, as calculated by the RealVol daily formula, over the entire period. In other words, the partial volatility (PVOL) converges to realized volatility (RVOL) for the entire CP after all of the data are known.

|

|

|

©

Copyright 2010-2021 RealVol LLC. All rights reserved

• Site Map

|

|