IVOL — Inferred Volatility Stat

IVOL stat is a volatility value that can be inferred from the market price of a RealVol futures and its PVOL stat (partial volatility stat). The concept is similar to the notion of implied volatility. Implied volatility is the relative expensiveness of an option’s premium as calculated via an options pricing model and solving for the volatility input. Similarly, inferred volatility is the relative expensiveness of a RealVol futures price obtained by applying a root-mean-square formula (perhaps more than once) to the PVOL and the current RealVol futures price. The result is the aggregate of traders’ forecasts (including perhaps a risk premium) of the remaining realized volatility until expiration of the RealVol futures. Many traders would compare implied volatility to inferred volatility to judge the relative expensiveness between options and RealVol futures, respectively.

Inferred Vol within the RealVol Calculation Period

Once the calculation period (CP) begins,

each night's close brings another data point to the RealVol daily formula,

and, ultimately, to the calculation of the expiration settlement

of RealVol futures. The returns already logged

furnish a PVOL, which contributes to part of the RealVol futures'

current price.

However, other than at the expiration itself, at any point during

the CP, a RealVol futures' value depends not only on the PVOL but

also on traders' perception of the realized volatility remaining

to be displayed by the underlying asset. Indeed, once we know

the PVOL and the current market price of the RealVol futures, we may

infer the traders' estimate of remaining volatility by a straightforward

mathematical formula.

Suppose, for example, that 12 trading days of the 21-day CP

of a September 1VOL have passed, and that PVOL is 25.00. Nine

trading days remain to expiration, and the current price of the

RealVol futures is, say, 27.00. What estimate of realized volatility

for the remaining nine trading days may we infer from that price?

Application of the so-called root-mean-square formula tells us

that the correct answer is 29.46.

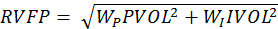

In essence, if IVOL is the estimate of remaining realized volatility,

we solve the following formula for IVOL:

Where:

RVFP = RealVol futures price (current market)

WP = the fractional weight attributed to the partial-volatility

(PVOL) period

PVOL = Partial realized volatility

WI = the fractional weight attributed to the inferred-volatility

(IVOL) period

IVOL = Inferred Volatility

Substitution of the values into the formula yields:

Solving, we obtain IVOL = 29.46.

In addition to providing PVOLs throughout the CP, RealVol intends

to disseminate IVOLs as a

further aid to traders of RealVol futures. Options traders, in particular,

may want to compare these IVOLs to the implied volatilities of

options whose maturities match that of the RealVol futures, as spread

opportunities might arise. For example, suppose IVOL is 29.50

and at-the-money (ATM) options implied volatilities are, say,

32.00. We might consider a trade wherein we buy the RealVol futures

and sell an ATM straddle. We then delta-neutral hedge the straddle,

to expiration. We might, therefore, capture all, or part, of the

differential between the 32.00 implied volatility of the options

and the 29.50 inferred volatility of the RealVol futures.

Note: The resulting volatility captured via delta-neutral hedging

of an options position may differ from the volatility realized

by the underlying for many reasons including, but not limited

to, the actual path of the underlying price movement, the precise

execution prices for any follow-up trades, and transaction costs.

One should understand all of the risks before implementing such

a trading strategy.

Inferred Vol Outside of the CP

Finally, although a somewhat more involved calculation, it is

possible to infer a realized volatility for any remaining time

period to the expiration of a RealVol futures, even before the start

of that contract's CP, and for which, therefore, no PVOL is yet

available. The following serves as an illustration of such a calculation.

Suppose, for simplicity, that RealVol futures expire on the last

calendar day of the month. Suppose, as well, that it is February

1, and that we are one month into the CP of a 3VOL that expires

on March 31. In addition, the next quarterly 3VOL, which expires

on June 30, and whose CP begins on April 1, is also listed and

currently trading. Prices are as follows: PVOL of the March 3VOL:

20.00; current market price of the March 3VOL: 22.00; and current

market price of the June 3VOL: 24.00. What IVOL may we deduce

for the period beginning on the current date (February 1) until

the expiration (June 30) of the June 3VOL? The following series

of calculations may be used to derive the answer.

First, applying the same technique as utilized earlier, we determine

the IVOL of the March 3VOL, for the February 1-March 31 period.

The root-mean-square formula yields 22.93 for the IVOL of this

March contract.

Next, we observe that the current market price of the June 3VOL

is 24.00, and that this price reflects the realized-volatility

forecast for the period of April 1-June 30. A weighted value of

the aforementioned 22.93 IVOL, for February 1-March 31, and the

24.00 forecast, for the period of April 1-June 30, is now obtained

from a second application of the root-mean-square formula.

Where:

IVOL = Inferred Vol for the period of February 1-June 30

W1 = the fractional weight attributed to the first

inferred-volatility period

IVOL1 = Inferred Volatility of the March 3VOL

W2 = the fractional weight attributed to the second

inferred-volatility period

IVOL2 =Inferred Volatility of the June 3VOL (equals

the current price)

The resulting IVOL, which can be interpreted as the Inferred

Vol for the period of February 1-June 30, is 23.58.

In conclusion, one can deduce implied volatility from options

prices, and one can also get an inferred volatility from RealVol futures

prices. Market participants can watch the spread between implied

volatility and inferred volatility for additional trading opportunities.

|

|

|

©

Copyright 2010-2021 RealVol LLC. All rights reserved

• Site Map

|

|